For companies with an existing in-house accounting and finance team, partnering with an outsourcing company offers benefits. This collaboration allows current staff to work alongside specialists, gaining expertise in technical areas. The close association with an outsourcing partner provides valuable learning opportunities for the in-house team. It means outsourcing may provide you with the possibility to hire a bookkeeper with a greater level of expertise at an affordable rate.

With this service, their CPAs manage bookkeeping while also budgeting, forecasting, doing job costing, managing cash flow, tracking inventory, and performing other financial management tasks on your behalf. Outsourcing finance and accounting services are an increasingly popular way for companies of all sizes to save money. They are looking not only at the cost-saving benefits but also finding new ways their business can benefit from this partnering approach with skilled professionals in these fields who know they don’t always possess themselves. This article will explore what accounting functions can be outsourced, the benefits of accounting for small businesses, and the top ten reasons to outsource bookkeeping and other accounting services.

Are you ready to take your business to the next level?

Whether you lack in-house F&A experience to address a complex project or the capacity to take on an interim need, we can plug in to assist you. We provide hands-on resources to help stand up your department and meet urgent demands and deadlines. With 15,000+ articles, and 2,500+ firms, the platform covers all major outsourcing destinations, including the Philippines, India, Colombia, and others. Every second spent on activities that don’t move your company forward is a second you will never get back. Outsourced accounting solutions provide a clear separation of duties and greater oversight to mitigate these risks.

- But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing.

- Tax accounting is the process of recording and summarizing financial information for tax purposes, which are governed by local regulations such as the Internal Revenue Code in the US.

- As you’ve probably learned by now, taxes are an inevitable part of doing business in the United States.

Given the wide array of scope of business processes in the outsourcing sector, accounting functions are among the outsourced services today. One of the main reasons why a lot of companies contract out parts of their roles is its cost-effectiveness. As your business grows, you will discover yourself spending more time handling your money and less time expanding the business. If you have extra funds to afford the in-house accountant, use its knowledge and abilities to produce sales and optimize your business expenses. And on the accounting software front, Bookkeeper360 syncs with both Xero and QuickBooks Online.

What is Natural Language Processing (NLP) and How it Can Transform Your Business

Contact us today to discuss outsourcing accounting functions as you grow your business. For more than four decades, Bennett Thrasher has provided businesses and individuals with strategic business guidance and solutions through professional tax, audit, advisory and business process outsourcing services. To learn more about the best outsourced accounting options for your company, contact Chris Tomaselli, partner in charge of Bennett Thrasher’s Outsourced Accounting practice. With longer-term outsourced and co-sourced partnerships, we help provide scalability and agility when you need it most. Cost of outsourced accounting services usually goes up based on complexity, but it is usually still far more affordable for small businesses to outsource accounting than it is to hire a full-time accountant internally.

Your employees could lose future Social Security, Medicare, or unemployment benefits if those funds aren’t paid. So take care of your obligations—and your employees—by making complete payroll tax payments on time. Your company pays these taxes entirely, so nothing is withheld from employee paychecks. This payment must be deposited quarterly to the EFTPS by the last day of the month after the end of each quarter. Even if you’re self-employed with no additional employees, you’re still required to remit payroll taxes on your own salary.

Advantages of Outsourcing Accounting Services

Forensic accountants investigate incidents involving fraud, bribery, and money laundering by analyzing financial records while tracing assets. The work can be challenging, but it’s worth every second when you discover that someone has been committing these acts against your company. This data reflects the financial situation regarding earnings, expenses, and other relevant information for wise decision-making based on this knowledge.

Of course you can hire a dedicated, full-time accountant, but this is an expensive option that often doesn’t yield the results businesses are looking for. Contact us today to learn more about how we can help your business thrive. When considering financial services, always keep your business needs in mind. How much debits and credits definition privacy or security will depend on the type of data being shared with an outsourced team and which tasks must remain exclusive to us because they’re too sensitive for outsourcing (for example handling payments). Outsourcing Finance and Accounting Services can be a powerful tool for digital business transformation.

Daniel E. Greene, CPA Firm Achieves $99,000 Cost Savings with QXAS Outsourcing

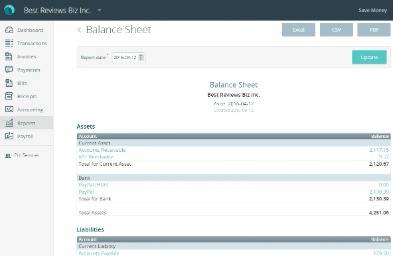

The decision to outsource your company’s finance and accounting needs is enormous. Regarding financial record keeping, accounting and audit play different roles in the process. You can outsource more complex functions such as financial analysis, forecasting, etc., rather than just basic bookkeeping. The F&A Industry has been steadily moving into the digital space, making keeping financial reports and books more accessible.